WASHINGTON, D.C. 20549

BlackRock, Inc.

| | 2) | | | 2) | Form, Schedule or Registration Statement No.: | | | 3) | | Filing Party: | | | 4) | | Date Filed: |

2018 PROXY STATEMENT Notice of Annual Meeting May 23, 2018 New York, New York

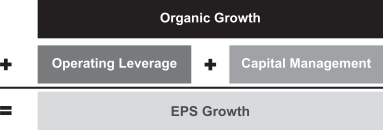

Generating Long-Term Shareholder Value BlackRock’s mission is to provide better financial futures for our clients. Our framework for creating long-term shareholder value is directly aligned with that mission. BlackRock, Inc. (“BlackRock” or the “Company”) has strategically invested to build a broad, diverse investment platform, strong technology and risk management capabilities and a global footprint to meet clients’ needs in all market environments. Our diverse platform enables us to generate consistent financial results and continuously invest in our business through market cycles. We believe that continuously investing in our platform to meet clients’ evolving needs enables us to: | | | | | | | | | | | Generate differentiated organic growth | | | | Leverage our scale for the benefit of clients and shareholders | | | | Return capital to shareholders on a consistent and predictable basis | | |

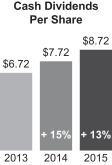

This framework was developed in close collaboration with our Board of Directors (the “Board”), and the Board continues to play an active role in overseeing our broader strategy and in measuring our ability to successfully execute it. BlackRock remains focused on investing for the future. Throughout BlackRock’s history, we have demonstrated an ability to optimize organic growth in the most efficient way possible while prudently returning capital to shareholders. We prioritize investment in our business to first drive growth and then return “excess” cash flow to shareholders. Our capital return strategy is balanced between dividends, where we target a 40-50% payout ratio, and a consistent share repurchase program. In 2018, we will continue to invest in BlackRock’s future – to grow our asset management and technology capabilities, to expand our geographic footprint and to further enhance our talent – to ensure we are meeting our daily responsibilities to our clients and delivering financial returns for shareholders.

BlackRock, Inc.55 East 52nd Street

PRELIMINARY COPY—SUBJECT TO COMPLETIONNew York, New York, 10055

April [15], 201613, 2018 Fellow Stockholder:To Our Shareholders:

Thank you for your confidence in BlackRock. It is my pleasure to invite you to BlackRock, Inc.’s 2016our 2018 Annual Meeting, of Stockholders. We will holdto be held on May 23, 2018 at the meeting on Wednesday, May 25, 2016, beginning at 8:00 a.m., local time, at theLotte New York Palace Hotel, 455 Madison Avenue, New York, New York 10022.

The attached Notice of Annual MeetingHotel. As we do each year, we will review our business and financial results for the year, address the voting items in the Proxy Statement describe the business that we will conduct atand take your questions. Whether you plan to attend the meeting or not, your vote is important and provide information about BlackRock.we encourage you to review the enclosed materials and submit your proxy.

As bothBlackRock celebrates its 30th anniversary this year, I have the opportunity to reflect on the most pressing issues facing investors today and how BlackRock must continue to adapt to serve clients’ needs effectively. It is a great privilege and responsibility to manage the assets entrusted to us, most of which are invested for long-term goals such as retirement. Just as we believe in the importance and benefits of clients investing for the long-term, we also approach BlackRock with that same future perspective. You can find more detail about BlackRock’s purpose and strategy for future growth in my letter to shareholders in this year’s Annual Report. In 2017, BlackRock continued to deliver on each component of our framework for creating long-term shareholder value, while simultaneously investing in our business. Our diverse asset management platform, industry leading technology and risk management capabilities and thought leadership enabled us to generate $367 billion of net inflows during the year, representing 7% organic asset growth and reflecting the trust we have earned from clients to help solve their most difficult investment challenges. We continued to invest in our business for future growth while simultaneously expanding our operating margin and returned $2.8 billion to shareholders through a combination of dividends and share repurchases. The execution of our strategy is dependent on a strong corporate governance framework. Whether acting as a fiduciary and a public company,for clients or shareholders, we believe that good corporate governance is critical to achieving sustainable returns over the long term. Wemeeting our overall objectives. That includes engaging with you, our shareholders, to better understand and address issues that are important to you. To support our mission of creating better financial futures for clients, we are vocal advocates for the adoption of sound corporate governance policies that include strong boardBoard leadership, prudent management practices and transparency. thoughtful strategic deliberations. We believe that we haveBlackRock has implemented such a corporate governance framework at BlackRock, including the “proxy access” proposalset of principles, guidelines and practices that we are submittingsupport sustainable financial growth and long-term value creation for your approval,shareholders and hope that you will find that reflected in the attached Proxy Statement. We also encourageagree as you to review the attached materials and submit your proxy, whether you plan to attend the meeting or not. Your vote is important. If you plan to attend the meeting in person, you will need to request an admission ticket in advance. You can request a ticket by following the instructions set forth on page 2 ofread the Proxy Statement. Whether

It has always been important that BlackRock’s Board of Directors functions as a key strategic and governing body that challenges our leadership team to be better and more innovative. BlackRock’s Board continues to play an integral role in our governance, growth and success. Thank you planagain for your commitment to attend the meeting or not, please review the attached materialBlackRock. Our Board of Directors and submit your proxy promptly by telephone or via the Internet in accordance with the instructions in the Notice of Internet Availability of Proxy Materials or on the attached proxy card, or by completing, signing, dating and returning the attached proxy card. Doing so will help ensure that the matters coming before the meeting can be acted upon. Returning the proxy card or otherwise submitting your proxy does not deprive you of your right to attend the meeting and vote in person. WeI look forward to seeing you at the meeting.on May 23, 2018 in New York City.

Sincerely,

Laurence D. Fink Chairman and Chief Executive Officer Just as we believe in the importance and benefits of clients investing for the long-term, we also approach BlackRock Inc.with that same future perspective. 55 East 52nd Street, New York, New York 10055

Annual Meeting of Shareholders PRELIMINARY COPY—SUBJECT TO COMPLETION

April [15], 2016

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

We will hold the Annual Meeting of Stockholders of BlackRock, Inc. at the New York Palace Hotel, 455 Madison Avenue, New York, New York 10022, on Wednesday, May 25, 2016, beginning at 8:00 a.m., local time. Shareholders

| | | | | Date: | | Wednesday, May 23, 2018 | | | Time: | | 8:00 AM EDT | | | Place: | | Lotte New York Palace Hotel 455 Madison Avenue New York, New York 10022 | | | Record Date: | | March 29, 2018 | | |

Agenda and Voting Matters At or before our Annual Meeting, we will ask that you to:vote on the following items:

| | | | | | | | | | | | | | | (1) | elect 19 directors to serve on our Board of Directors; | |

| | (2) | approve, by non-binding advisory | | How to vote:Your vote is important | | | | | | |

| |

| |

| |

| | | | | | | Internet Visit the compensation ofwebsite listed on your

proxy card. You will need the named executive officers (the “NEOs”) as disclosed

control number that appears on

your proxy card when you access

the web page. | | Mail Complete and discussedsign the proxy card

and return it in the Proxy Statement;enclosed postage

pre-paid envelope. |

| | (3) | ratifyTelephone If your shares are held in the appointmentname of Deloitte & Touche LLP as BlackRock’s independent

a broker, bank or other nominee: follow

the telephone voting instructions, if any,

provided on your voting instruction card.

If your shares are registered public accounting firm for in your

name: call1-800-690-6903 and follow

the year 2016; |

telephone voting instructions. You willneed the control number that appears onyour proxy. | | (4) | consider and approve a management proposal to amend the bylaws to implement “proxy access”; |

In Person You may attend the Annual Meeting

and vote by ballot. Your admission

ticket to the Annual Meeting is either

attached to your proxy card or is in

the email by which you received your

Proxy Statement. | (5) | consider and vote on a stockholder proposal, if properly presented at the Annual Meeting; and |

| (6) | consider any other business that is properly presented at the Annual Meeting. |

You may vote at the Annual Meeting if you were a BlackRock stockholder at the close of business on March 30, 2016, the record date for the Annual Meeting.

Please note that we are furnishing proxy materials and access to a virtual interactive proxy statementour Proxy Statement to our stockholdersshareholders via the Internet,our website instead of mailing printed copies of those materials to each stockholder.shareholder. By doing so, we save costs and reduce our impact on the environment. Beginning on April [15], 2016,13, 2018, we will mail or otherwise make available to each of our stockholdersshareholders a Notice of Internet Availability of Proxy Materials, which contains instructions about how to access our proxy materials and vote online. If you attend the Annual Meeting, you may withdraw your proxy and vote in person, if you so choose. If you would like to receive a paper copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. If you previously chose to receive our proxy materials electronically, you will continue to receive access to these materials via e-mail unless you elect otherwise.

Your vote is important and we encourage you to vote promptly whether or not you plan to attend the 20162018 Annual Meeting of StockholdersShareholders of BlackRock, Inc. By Order of the Board of Directors,

| | | R. Andrew Dickson III Corporate Secretary April 13, 2018 | | BlackRock, Inc. 5540 East 52nd52nd Street,

New York, New York 1005510022 Important Notice Regarding the Availability of Proxy Materials for the 2016 Annual Meeting of Stockholders to be held on Wednesday, May 25, 2016: Our Proxy Statement and 2015 Annual Report are available free of charge on our website at[•].

TABLE OF CONTENTS

|

Important Notice Regarding the Availability of Proxy Materials for the 2018 Annual

Meeting of Shareholders to be held on Wednesday, May 23, 2018: our Proxy

Statement and 2017 Annual Report are available free of charge on our website at

www.blackrock.com/corporate/en-us/investor-relations

Proxy Summary This summary provides an overview of selected information in this year’s Proxy Statement. We encourage you to read the entire Proxy Statement before voting. Annual Meeting of Shareholders | | | Once a person has been identified by the Governance Committee as a potential director candidate, the Governance Committee collects and reviews publicly available information regarding the candidate to assess whether the candidate should be considered further. If the Governance Committee determines that the candidate warrants further consideration, the Chairperson or a person designated by the Governance Committee will contact the candidate. If the candidate expresses a willingness to be considered and to serveDate

| | Wednesday, May 23, 2018 | Time | | 8:00 AM EDT | Location | | Lotte New York Palace Hotel 455 Madison Avenue New York, New York 10022 | Record Date | | March 29, 2018 |

Voting Matters Shareholders will be asked to vote on the following matters at the Annual Meeting: | | | | | | | | | Board Recommendation | | ITEM 1. Election of Directors the Governance Committee typically requests information from the candidate and reviews the candidate’s accomplishments and qualifications against the criteria set forth below. The Governance Committee’s evaluation process does not vary based on whether a candidate is recommended by a stockholder, although the Committee may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held. Criteria for Board Membership

Director Qualifications and Attributes

The Governance Committee and the Board of Directors take into consideration a number of factors and criteria in reviewing candidates for nomination to the Board. As indicated in BlackRock’s Corporate Governance Guidelines, the Board of Directors believes that at a minimum a person must demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board of Directors’ oversight of the business and affairs of BlackRock and that a person has an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal activities.

In addition, nominees for director are selected on the basis of, among other things, experience, diversity, knowledge, skills, expertise, an ability to make independent analytical inquiries, understanding of BlackRock’s business environment and willingness to devote adequate time and effort to the responsibilities of the Board of Directors.

Consideration of Diversity and Experience

Although the Board of Directors has not set specific goals with respect to diversity, it believes a diverse mix of knowledge, experience, skills, backgrounds and viewpoints enhances the Board’s capabilities. In reviewing candidates, the Governance Committee takes into consideration a candidate’s professional background, gender, race, national origin and age. The Board addresses whether it has achieved an appropriate level of diversity as part of its consideration of the Board’s composition in its annual self-evaluation process and the Governance Committee periodically reviews the overall composition of the Board and its Committees to assess whether it reflects the appropriate mix of skill sets, experience, backgrounds and qualifications that are relevant to the Company’s current and future global strategy, business and governance.

In addition to the personal qualities and attributes described above, the Board looks for individuals who have demonstrated expertise and have global experience in the following disciplines: financial services, capital markets, public company governance, business operations, government regulation, public policy, and risk management. The Board also seeks candidates who have significant leadership experience, including current and former chief executive officers, who can share their perspective and practical experience on developing and implementing business strategies, setting appropriate executive compensation, and managing talent.

Consideration of Board Tenure

To ensure the Board of Directors has an appropriate balance of experience, continuity and fresh perspective, the Board takes into consideration tenure diversity when reviewing nominees. As of March 1, 2016, the average tenure of BlackRock’s directors was approximately 8.2 years (the average tenure for independent directors was 6.1 years). The Board believes that the current Board represents an effective mix of long-, medium- and short-tenured directors. Three non-management directors have served 15 years or more and bring a wealth of experience and knowledge concerning BlackRock, while six directors were added to the Board over the past four years and bring fresh perspectives to Board deliberations. The Board of Directors believes the current mix of tenures provides for a highly effective and well-functioning Board.

Compliance with Regulatory and Independence Requirements

In addition to the criteria described above, the Governance Committee takes into consideration regulatory requirements, including competitive restrictions and financial institution interlocks, and independence requirements under the NYSE listing standards and our Corporate Governance Guidelines in its review of candidates for the Board and Board Committees. The Governance Committee also considers a candidate’s current and past positions held, including past and present board and committee membership, as part of its evaluation.

Service on Other Public Company Boards

Each of BlackRock’s directors mustdirector nominees have the timeknowledge, experience, skills and ability to make a constructive contribution to the Board, as well as a clear commitment to fulfilling the fiduciary duties required of directors and serving the interests of the Company’s stockholders. BlackRock’s Chief Executive Officer does not serve on the board of directors of any other public company, and none of our current directors serve on more than three public company boards, including BlackRock’s Board.

Board of Directors Recommendation

For this year’s election, the Board has nominated 19 candidates, all of whom are current directors of the Board, that it believes provide the Company with the combined depth and breadth of skills, experience and qualities neededbackgrounds necessary to contribute to an effective and well-functioning Board. The composition

| | | VoteFOR each director nominee | | ITEM 2. Approval, in a Non-Binding Advisory Vote, of the current Board reflectsCompensation for Named Executive Officers BlackRock seeks a diverse range of skills, qualifications and professional experience that is relevantnon-binding advisory vote from its shareholders to BlackRock’s global strategy, business and governance. The following biographical information regarding each director nominee highlightsapprove the particular experience, qualifications, attributes or skills possessed by each director nominee that led the Board of Directors to determine that such person should serve as director. We expect each nominee for election as a director to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favorcompensation of the remaindernamed executive officers as disclosed and discussed in this Proxy Statement. The Board values the opinions of those nominatedour shareholders and may be voted for substitute nominees, unlesswill take into account the Boardoutcome of Directors choosesthe advisory vote when considering future executive compensation decisions.

| | | VoteFOR | | ITEM 3. Approval of an Amendment to reducethe BlackRock, Inc. Second Amended and Restated 1999 Stock Award and Incentive Plan BlackRock is asking shareholders to approve an amendment to the BlackRock, Inc. Second Amended and Restated 1999 Stock Award and Incentive Plan (“Stock Plan”) to increase the number of directors serving onshares of common stock authorized for issuance under the Stock Plan. This increase will allow BlackRock to continue to provide equity incentive awards as part of ourpay-for-performance compensation program, which the Board believes is essential to maintaining a competitive compensation program aligned with shareholder interests. | | | VoteFOR | | ITEM 4. Ratification of Directors.the Appointment of the Independent Registered Public Accounting Firm All

The Audit Committee has appointed Deloitte LLP to serve as BlackRock’s independent registered public accounting firm for the 2018 fiscal year and this appointment is being submitted to our shareholders for ratification. The Audit Committee and the Board believe that the continued retention of Deloitte LLP to serve as BlackRock’s independent auditors is in the best interests of the Company and its shareholders. | | | VoteFOR | | ITEM 5. Shareholder Proposal — Production of an Annual Report on Certain Trade Association and Lobbying Expenditures The Board believes that the actions requested by the proponent are unnecessary and not in the best interest of our shareholders. | | | VoteAGAINST | |

BLACKROCK, INC. 2018 PROXY STATEMENT 1

| | | | | | | | | | | | | Proxy Summary ●Board Composition | | | | |

| | | | | What’s New? | | This year, we have updated our Proxy Statement to help you better understand BlackRock’s governance and compensation practices. We believe a broader understanding of BlackRock and our perspective on governance will be beneficial to you as you consider this year’s voting matters. This year’s updated items include: | | • | | Board refreshment through the election of three new directors | | | • | | Enhanced disclosure on our Board diversity and search process (see “Board Diversity” and “Director Candidate Search” on pages 10 and 11, respectively) | | | • | | Enhanced disclosure on our Board and BlackRock’s culture (see“Our Board and Culture: Engaged and vital to our success” on page 21 and“Director Engagement — BlackRock Corporate Culture and Purpose” on page 24) | | | • | | Updates to our Compensation Disclosure and Analysis | | | • | | BlackRock’s Mission Statement on Sustainability |

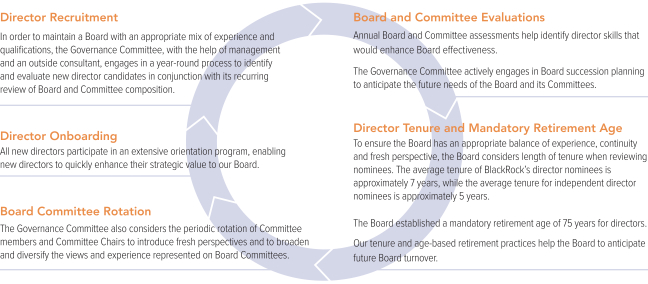

Board Composition (18 director nominees) The Nominating and Governance Committee (the “Governance Committee”) regularly reviews the overall composition of the Board and its Committees to assess whether they reflect the appropriate mix of skill sets, experience, backgrounds and qualifications that are relevant to BlackRock’s current and future global strategy, business and governance. Over the course of the past year, the Governance Committee identified three new candidates with strong senior executive, international, technology and financial services experience who were elected to the Board in March of this year. Board Tenure The Board considers length of tenure when reviewing nominees in order to maintain an overall balance of experience, continuity and fresh perspective. | | | | | | | 0 - 5 Years: | | 5 - 10 Years: | | 10+ Years: | | 7 years:Average tenure of all director nominee biographical informationnominees | 7 director nominees (39%) | | 5 director nominees (28%) | | 6 director nominees (33%) | | 5 years:Average tenure of independent director nominees |

Board Profile | | | | | | | | | | |  | | Current & Former CEOs 12 of 18 | |  | | Non-U.S. or Dual Citizens 6 of 18 | |  | | Women 5 of 18 |

Board Independence and Lead Independent Director Each year the Board reviews and evaluates our Board leadership structure. The Board has appointed Laurence Fink as its Chairman and Murry Gerber as its Lead Independent Director. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 15 | | of BlackRock’s 18 director nominees are independent |

2BLACKROCK, INC. 2018 PROXY STATEMENT

| | | | | | | | | | | | | Proxy Summary ●Our Director Nominees | | | |  |

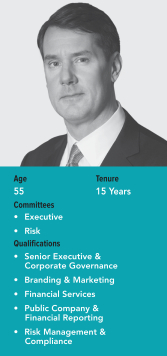

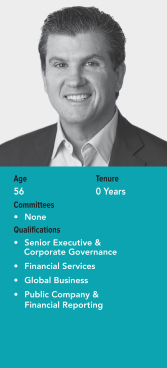

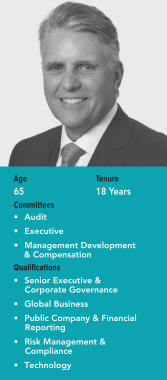

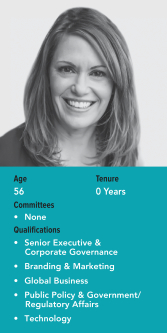

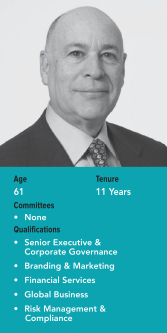

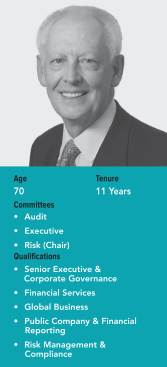

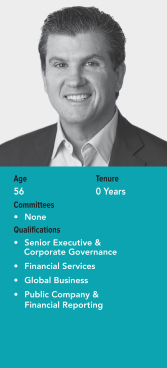

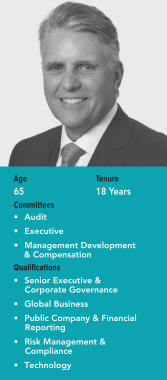

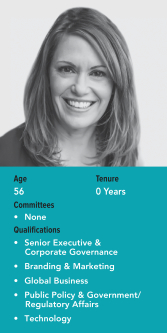

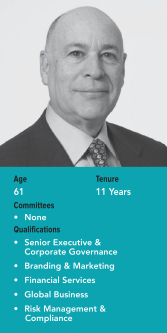

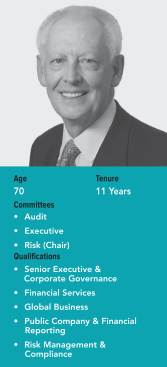

Our Director Nominees | | | | | | | | | | | | | | | | | | | | | | | | | | | | Committee Memberships | | | Nominee | | Age at

Record

Date | | Primary Occupation | | Director

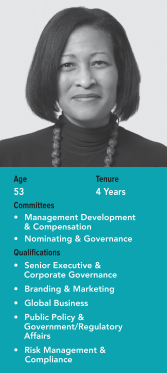

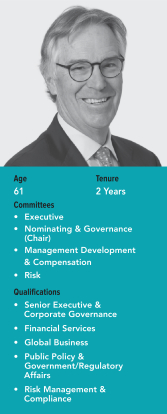

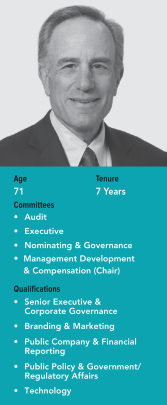

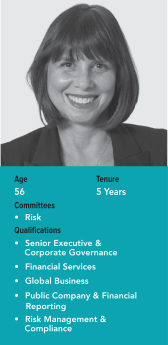

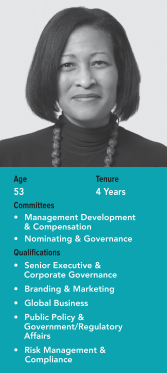

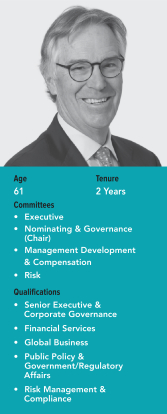

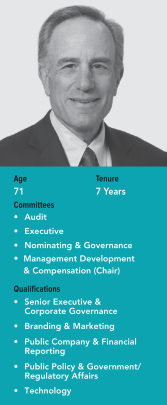

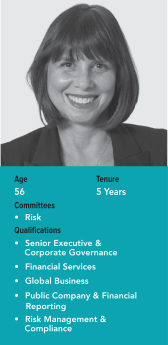

since | | Audit | | Compensation | | Governance | | Risk | | Executive | | | Mathis Cabiallavetta | | 73 | | Former Chairman of UBS, Vice Chairman of Swiss Re Ltd. and of Marsh & MacLennan Companies, Inc. | | 2007 | | ● | | | | ● | | ● | | | | | Pamela Daley | | 65 | | Former Senior Vice President of General Electric Company Corporate Business Development and Senior Advisor to Chairman | | 2014 | | Chair | | | | | | ● | | ● | | | William S. Demchak | | 55 | | Chairman, CEO and President of The PNC Financial Services Group, Inc. | | 2003 | | | | | | | | ● | | ● | | | Jessica P. Einhorn | | 70 | | Former Dean of Paul H. Nitze School of Advanced International Studies at The Johns Hopkins University and former Managing Director, World Bank | | 2012 | | | | ● | | | | ● | | | | | Laurence D. Fink | | 65 | | Chairman and CEO of BlackRock | | 1999 | | | | | | | | | | Chair | | | William E. Ford | | 56 | | CEO of General Atlantic | | 2018 | | | | | | | | | | | | | Fabrizio Freda | | 60 | | President and CEO of The Estée Lauder Companies Inc. | | 2012 | | | | | | ● | | | | | | | Murry S. Gerber Lead Independent Director | | 65 | | Former Executive Chairman, Chairman, President and CEO of EQT Corporation | | 2000 | | ● | | ● | | | | | | ● | | | Margaret L. Johnson | | 56 | | Executive Vice President of Business Development of Microsoft Corporation | | 2018 | | | | | | | | | | | | | Robert S. Kapito | | 61 | | President of BlackRock | | 2006 | | | | | | | | | | | | | Sir Deryck Maughan | | 70 | | Former Senior Advisor, Partner and Managing Director of Kohlberg Kravis Roberts & Co. L.P. | | 2006 | | ● | | | | | | Chair | | ● | | | Cheryl D. Mills | | 53 | | Founder and CEO of BlackIvy Group and former

Chief of Staff to Secretary of State Hillary Clinton | | 2013 | | | | ● | | ● | | | | | | | Gordon M. Nixon | | 61 | | Former President, CEO and Director of

Royal Bank of Canada | | 2015 | | | | ● | | Chair | | ● | | ● | | | Charles H. Robbins | | 52 | | Chairman and CEO of Cisco Systems, Inc. | | 2017 | | | | | | | | ● | | | | | Ivan G. Seidenberg | | 71 | | Former Chairman and CEO of Verizon

Communications Inc. | | 2011 | | ● | | Chair | | ● | | | | ● | | | Marco Antonio Slim Domit | | 49 | | Chairman of Grupo Financiero Inbursa, S.A.B. de C.V. | | 2011 | | ● | | ● | | | | | | | | | Susan L. Wagner | | 56 | | Former Vice Chairman of BlackRock | | 2012 | | | | | | | | ● | | | | | Mark Wilson | | 51 | | CEO of Aviva plc | | 2018 | | | | | | | | | | | | |

BLACKROCK, INC. 2018 PROXY STATEMENT 3

| | | | | | | | | | | | | Proxy Summary ●Governance Highlights | | | | |

Governance Highlights We are vocal advocates for the adoption of sound corporate governance policies that include strong Board leadership, prudent management practices and transparency. Highlights of our governance practices include: Annual election of directors Majority voting for directors in uncontested elections Lead Independent Director may call special meetings of directors without management present Executive sessions of independent directors Annual Board and Committee evaluations Risk oversight by Board and Committees Strong investor outreach program Robust stock ownership requirements for directors and executives Annual advisory approval of executive compensation Adoption of proxy access Annual review of Committee charters and Corporate Governance Guidelines Stock Ownership Guidelines Our stock ownership guidelines require the Company’s Global Executive Committee (“GEC”) members to own and maintain shares with a target value of: | | | | • $10 million for the Chief Executive Officer (“CEO”); | | As of December 31, 2017, all NEOs exceeded our stock ownership guidelines. | | • $5 million for the President; and | | | • $2 million for all other GEC members. | |

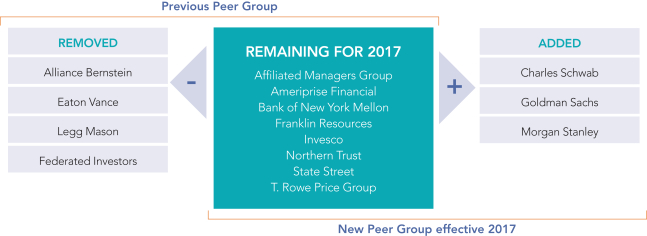

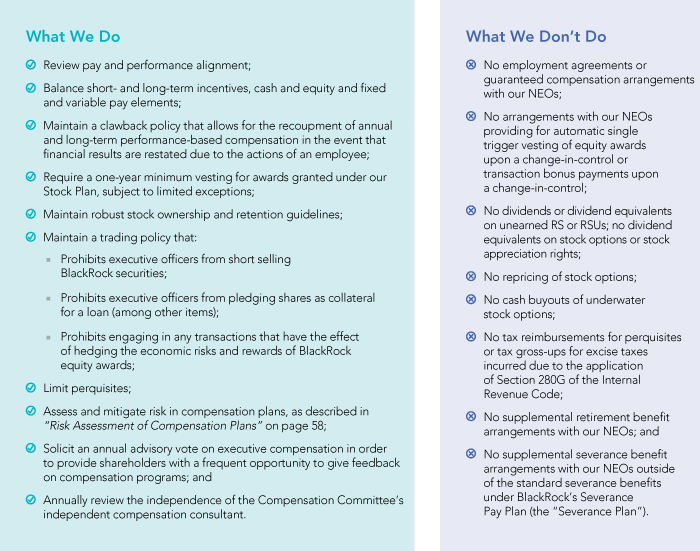

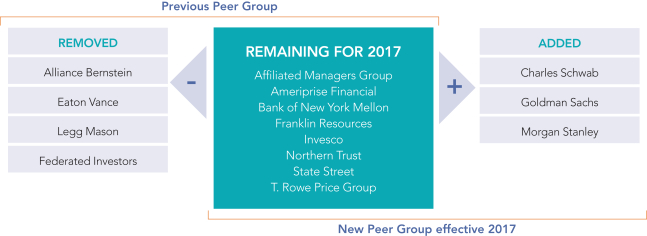

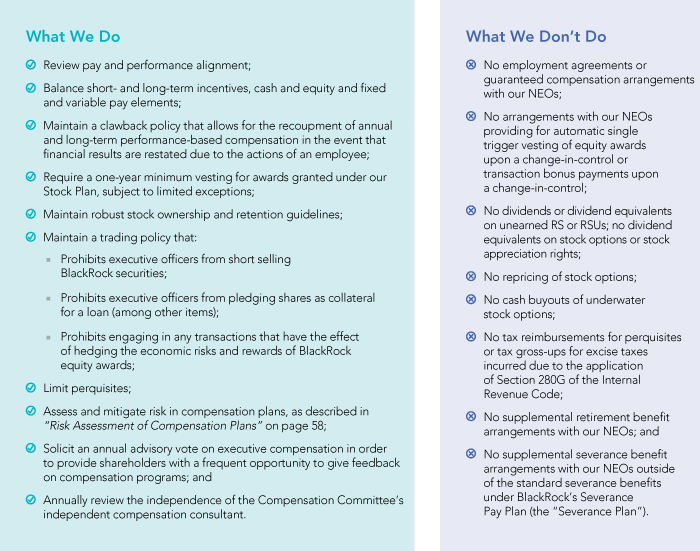

Shareholder Engagement and Outreach We conduct shareholder outreach throughout the year to engage with shareholders on issues that are important to you. We report back to our Board on this engagement and on specific issues to be addressed. Executive management, Investor Relations and the Corporate Secretary engage on a regular basis with shareholders to understand their perspectives on a variety of corporate governance matters, including executive compensation, corporate governance policies and corporate sustainability practices. We also communicate with shareholders through a number of routine forums, including quarterly earnings presentations, U.S. Securities and Exchange Commission (“SEC”) filings, the Annual Report and Proxy Statement, the annual shareholder meeting, investor meetings and conferences and web communications. We relay shareholder feedback and trends on corporate governance and sustainability developments to our Board and its Committees and work with them to both enhance our practices and improve our disclosures. Compensation Policies and Practices Our commitment to design an executive compensation program that is consistent with responsible financial and risk management is reflected in the following policies and practices: | | | |  | • | | Review pay and performance alignment; | | • | | Balance short and long-term incentives, cash and equity, and fixed and variable pay elements; | | • | | Maintain a clawback policy; | | • | | Requireone-year minimum vesting for awards granted under the Stock Plan; | | • | | Maintain robust stock ownership and retention guidelines; | | • | | Prohibit hedging, pledging or short selling BlackRock securities; | | • | | Limit perquisites; | | • | | Assess and mitigate compensation risk; | | • | | Solicit annual advisory vote on executive compensation; and | | • | | Annually review the independence of the compensation consultant retained by the Management Development & Compensation Committee (the “Compensation Committee”). |

| | | |  | • | | No ongoing employment agreements or guaranteed compensation arrangements for NEOs; | | • | | No automatic single trigger vesting of equity awards or transaction bonus payments uponchange-in-control; | | • | | No dividends or dividend equivalents on unearned restricted stock, restricted stock units, stock options or stock appreciation rights; | | • | | No repricing of stock options; | | • | | No cash buyouts of underwater stock options; | | • | | No tax reimbursements for perquisites; | | • | | No taxgross-ups for excise taxes; | | • | | No supplemental retirement benefits for NEOs; and | | • | | No supplemental severance benefits for NEOs beyond standard severance benefits under BlackRock’s Severance Pay Plan. |

4BLACKROCK, INC. 2018 PROXY STATEMENT what we do what we don’t do

| | | | | | | | | | | | | Proxy Summary ●2017 Performance Highlights | | | |  |

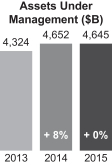

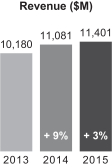

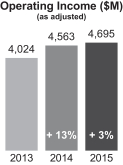

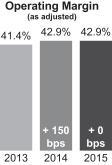

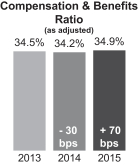

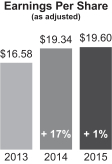

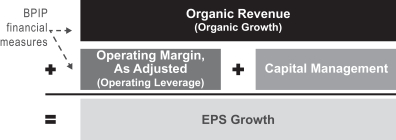

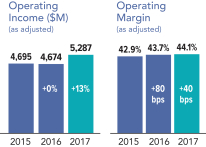

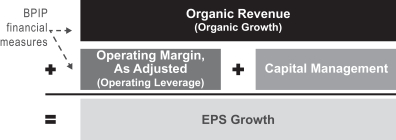

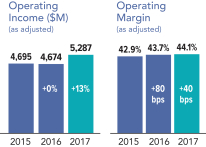

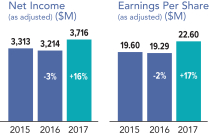

2017 Performance Highlights1 The strength of BlackRock’s 2017 results reflect the long-term strategic advantages we have created by consistently investing in our business. Full-year results reflected industry-leading organic growth, with record full-year net inflows of $367 billion, continued Operating Margin expansion and consistent capital management. Investment performance results across our alpha-seeking and index strategies as of December 31, 2017 remain strong and are detailed in Item 1 of our 2017 Form10-K. Differentiated Organic Growth Organic Assetgrowth of 7% in 2017 contributed to strong Organic Revenue growth2

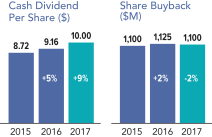

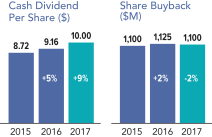

Consistent Capital Return $2.8 billion was returned to shareholders in 2017 through a combination of dividends and $1.1 billion of share repurchases

Operating Leverage Operating Margin, as adjusted, of 44.1% was up40 bps from 2016

Earnings Growth Diluted earnings per share, as adjusted, of $22.60increased 17% versus 2016

| 1 | Amounts in this section, where noted, are shown on an “as adjusted” basis. For a reconciliation with generally accepted accounting principles (“GAAP”) in the United States, please see Annex A. |

| 2 | Organic Revenue growth is a measure of the expected annual revenue impact of BlackRock’s total net new business in a given year, including net newAladdin revenue, excluding the effect of market appreciation/ (depreciation) and foreign exchange. Organic Revenue is not directly correlated with the actual revenue earned in such given year. |

BLACKROCK, INC. 2018 PROXY STATEMENT 5 Assets Under Management ($B) Revenue ($M) Operating Income ($M) (as adjusted)2 Operating Margin (as adjusted)2 Cash Dividend Per Share ($)Share Buyback ($M) Net Income ($M) Earnings Per Share (as adjusted)2 ($M)

| | | | | | | | | | | | | Proxy Summary ●How We Determine Annual Incentive Amounts for Our CEO and President | | | | |

How We Determine Annual Incentive Amounts for Our CEO and President | | | | | | | | | | | | | | | | | | | BlackRock Performance % of Award Opportunity | | | | Measures | | | | BlackRock Performance | | | | | | | | | 2016 | | 2017 | | Change | Financial Performance

| | | | Net New Business ($bn) | | | | $202 | | $367 | | +82% | | | | | Net New Base Fee Growth | | | | 4% | | 7% | | +300bps | | | | | Operating Income, as adjusted1 ($m) | | | | $4,674 | | $5,287 | | +13% | | | | | Operating Margin, as adjusted1 | | | | 43.7% | | 44.1% | | +40 bps | | | | | Diluted Earnings Per Share, as adjusted1 | | | | $19.29 | | $22.60 | | +17% | | | | | Share Price Data | | | | BLK | | LC Traditional Peers2 | | | | | NTM P/E Multiple3 | | | | 20.2x | | 14.3x | | | | | Annual appreciation | | | | 35% | | 28% | Business Strength

| | | | Deliver superior client experience through competitive investment performance across global product groups | | | | BlackRock’s alpha-seeking investments platform delivered very strong performance in 2017 and improved performance against peers | | | | | Drive organization discipline through execution of our strategic initiatives | | | | Demonstrated successful execution across multiple complex strategic initiatives that have positioned the Company well for growth | | | | | Lead in a changing world | | | | Elevated the use of technology across the organization and made progress in advancing BlackRock’s technology agenda | Organizational Strength

| | | | Drive high performance | | | | Advanced the high performance goal through execution of key senior talent moves in 2017 | | | | | Build a more diverse and inclusive culture | | | | Strong progress in 2017 diverse hiring to meet or exceed company-wide 2020 diversity targets | | | | | Develop great managers and leaders | | | | Continued to focus on manager excellence, succession planning, the depth of our leadership bench, and proactive development of key talent |

| 1. | Amounts are shown on an “as adjusted” basis. For a reconciliation with GAAP in the United States, please see Annex A. |

| 2. | Large Cap (“LC”) Traditional Peers refers to Alliance Bernstein, Affiliated Managers Group, Inc., Franklin Resources, Inc., Eaton Vance, Invesco, Legg Mason and T. Rowe Price. |

| 3. | NTM P/E multiple refers to the Company’s share price as of March 1, 2016.December 31, 2017 divided by the consensus estimate of the Company’s expected earnings over the next 12 months. Sourced from Factset. |

In addition to annual incentive awards, the Compensation Committee expects to continue to make annual grants of long-term equity awards to both Messrs. Fink and Kapito, with at least half of such awards being contingent on future financial or other business performance requirements in addition to share price performance. 6BLACKROCK, INC. 2018 PROXY STATEMENT

| | | | | | | | | | | | | Proxy Summary ●NEO Total Annual Compensation Summary | | | |  |

NEO Total Annual Compensation Summary Following a review of full-year business and individual Named Executive Officer (“NEO”) performance, the Compensation Committee determined 2017 total annual compensation outcomes for each NEO, as outlined in the table below. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2017 Annual Incentive Award | | | | | | | | | | | | | | | | | | | | | | Name | | Base

Salary | | | Cash | | | Deferred

Equity | | | Long-Term

Incentive Award

(“BPIP”) | | | Total Annual

Compensation

(“TAC”) | | | % change in

TAC vs. 2016 | | | Performance-

Based Stock

Options | | Laurence D. Fink | | $ | 900,000 | | | $ | 10,000,000 | | | $ | 4,600,000 | | | $ | 12,450,000 | | | $ | 27,950,000 | | | | 10% | | | | – | | Robert S. Kapito | | $ | 750,000 | | | $ | 8,125,000 | | | $ | 3,514,000 | | | $ | 9,626,000 | | | $ | 22,015,000 | | | | 10% | | | | – | | Robert L. Goldstein | | $ | 500,000 | | | $ | 3,275,000 | | | $ | 2,325,000 | | | $ | 2,100,000 | | | $ | 8,200,000 | | | | 12% | | | $ | 10,000,000 | | Mark S. McCombe | | $ | 500,000 | | | $ | 2,725,000 | | | $ | 1,775,000 | | | $ | 1,950,000 | | | $ | 6,950,000 | | | | 11% | | | $ | 10,000,000 | | Gary S. Shedlin | | $ | 500,000 | | | $ | 2,700,000 | | | $ | 1,750,000 | | | $ | 1,850,000 | | | $ | 6,800,000 | | | | 11% | | | $ | 7,500,000 | |

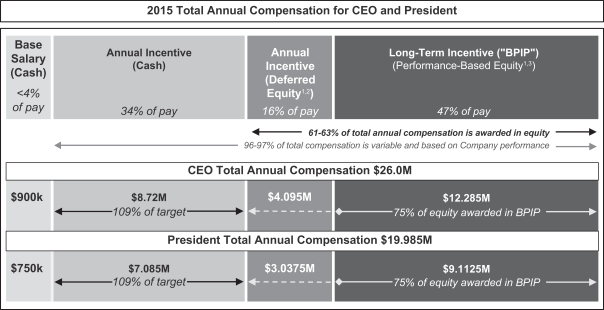

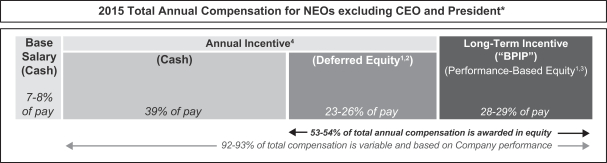

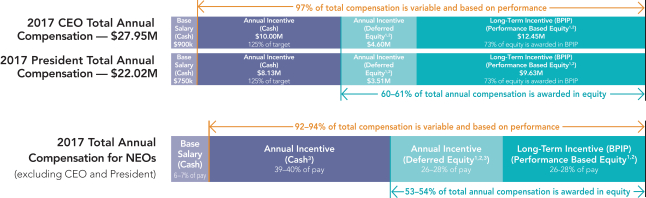

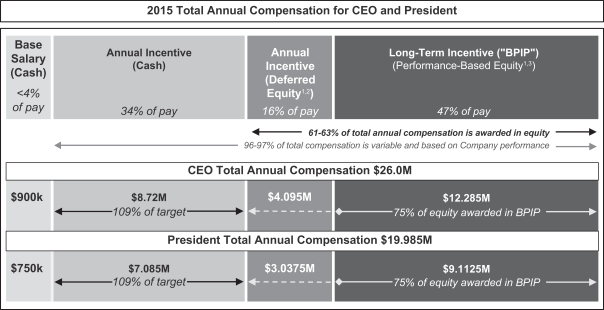

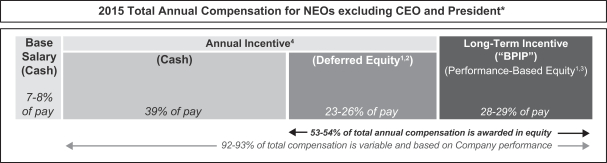

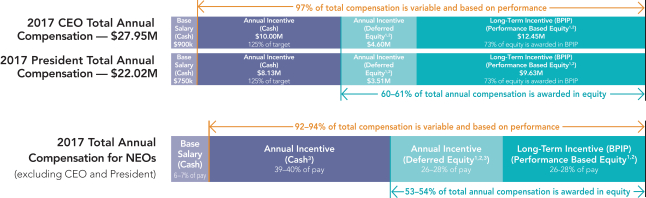

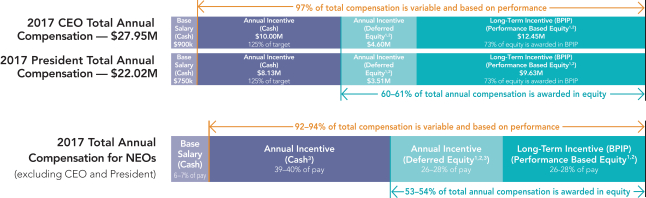

The amounts listed above as “2017 Annual Incentive Award: Deferred Equity” and “Long-Term Incentive Award (“BPIP”)” were granted in January 2018 in the form of equity and are separate from the cash award amounts listed above as “2017 Annual Incentive Award: Cash.” In conformance with SEC requirements, the 2017 Summary Compensation Table on page 68 reports equity in the year granted but cash in the year earned. In the fourth quarter of 2017, BlackRock implemented a key strategic part of our long-term management succession plans by granting long-term incentive awards in the form of performance-based stock options to a select group of senior leaders, excluding the CEO and President, who we believe will play critical roles in BlackRock’s future. Consequently, we do not consider these awards to be part of our regular annual compensation determinations for 2017. For more information regarding these performance-based stock options, see “Performance-Based Stock Options” on page 55. Pay-for-Performance Compensation Structure for NEOs Our total annual compensation structure embodies our commitment to align pay with performance. More than 90% of our regular annual executive compensation is performance based and “at risk.” Compensation mix percentages shown below are based on 2017year-end compensation decisions for individual NEOs by the Compensation Committee.

| 1 | All grants of BlackRock equity (including the portion of the annual incentive awards granted in Restricted Stock Units (“RSUs”) and BlackRock Performance Incentive Plan (“BPIP”) Awards) are approved by the Compensation Committee under the Stock Plan, which has been previously approved by shareholders. The Stock Plan allows multiple types of awards to be granted. |

| 2 | The value of the 2017 long-term incentive BPIP Awards and the value of the equity portion of the bonus for 2017 annual incentive awards was converted into RSUs by dividing the award value by $566.44, which represented the average of the high and low prices per share of common stock of BlackRock on January 16, 2018. |

| 3 | For NEOs other than the CEO and President, higher annual incentive awards are subject to higher deferral percentages, in accordance with the Company’s deferral policy, as detailed on page 50. |

2017 CEO Total Annual Compensation-$27.95M Base Salary (Cash) $900k 97% of total compensation is variable and based on performance Annual Incentive (Cash) $10.00M 125% of target Annual Incentive (Deferred Equity1,2) $4.6M Long-Term Incentive (BPIP) (Performance Based Equity1,2) $12.45M 75% of equity is awarded in BPIP 2017 President Total Annual Compensation- $22.02M Base Salary (Cash) $750k Annual Incentive (Cash) $8.13M 125% of target Annual Incentive (Deferred Equity1,2) $3.51M Long-Term Incentive (BPIP) (Performance Based Equity1,2) $9.63M 75% of equity is awarded in BPIP 60-61% of total annual compensation is awarded in equity 2017 Total Annual Compensation for NEOs (excluding CEO and President) Base Salary (Cash) 7-8% of pay 92-94% of total compensation is variable and based on performance Annual Incentive (Cash3) 39-40% of pay Annual Incentive (Deferred Equity1,2,3) 26-28% of pay Long-Term Incentive (BPIP) (Performance Based Equity1,2) 26-28% of pay 53-54% of total annual compensation is awarded in equity BLACKROCK, INC. 2018 PROXY STATEMENT 7

Item 1: Election of Directors

Director Nominees Our Board has nominated 18 directors for election at this year’s Annual Meeting on the recommendation of our Governance Committee. Each director will serve until our next annual meeting and until his or her successor has been duly elected, or until his or her earlier death, resignation or retirement. We expect each director nominee to be able to serve if elected. If a nominee is unable to serve, proxies will be voted in favor of the remainder of those directors nominated and may be voted for substitute nominees, unless the Board decides to reduce its total size. If all 18 nominees are elected, our Board will consist of 18 directors, 15 of whom, representing approximately 83% of the Board, will be “independent” as defined in the New York Stock Exchange (the “NYSE”) listing standards. Stockholder Agreement with The PNC Financial Services Group, Inc. BlackRock’s stockholder agreement with The PNC Financial Services Group, Inc. (the “PNC Stockholder Agreement”) provides, subject to the waiver provisions of the agreement, that BlackRock will use its best efforts to cause the election at each annual meeting of shareholders so that the Board will consist of: no more than 19 directors, not less than two nor more than four directors who will be members of BlackRock management, two directors who will be designated by PNC, and the remaining directors being independent for purposes of the rules of the NYSE and not designated by or on behalf of PNC or any of its affiliates. The PNC Financial Services Group, Inc. (“PNC”) has designated one member of the Board, William S. Demchak, Chairman, President and Chief Executive Officer of PNC. PNC has notified BlackRock that for the time being it will not designate a second director to the Board, although it retains the right to do so at any time in accordance with the PNC Stockholder Agreement. PNC has additionally been permitted to invite an observer to attend meetings of the Board as anon-voting guest. The PNC observer is Gregory B. Jordan, the General Counsel and Head of Regulatory and Governmental Affairs of PNC. Laurence D. Fink and Robert S. Kapito are members of BlackRock’s management team and are currently members of the Board. For additional detail on the PNC Stockholder Agreement, see“Certain Relationships and Related Transactions – PNC Stockholder Agreement” on page 40. 8BLACKROCK, INC. 2018 PROXY STATEMENT It has always been important that BlackRock’s Board of Directors functions as a key strategic and governing body that challenges our leadership team to be better and more innovative. Laurence D. Fink Chairman and Chief Executive Officer

| | | | | | | | | | | | | Item 1: Election of Directors ●Director Nominees | | | | |

Majority Vote Standard for Election of Directors Directors are elected by a majority of the votes cast in uncontested elections (the number of shares voted “for” a director nominee must exceed the number of shares voted “against” that director nominee). In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors would be a plurality of the shares represented in person or by proxy at any meeting and entitled to vote on the election of directors. Whether an election is contested is determined seven days in advance of when we file our definitive Proxy Statement with the SEC. Director Resignation Policy and Mandatory Retirement Age Under the Board’s Director Resignation Policy, any incumbent director who fails to receive a majority of votes cast in an uncontested election must tender his or her resignation to the Board. The Governance Committee would then make a recommendation to the Board about whether to accept or reject the resignation or take other action. The Board will act on the Governance Committee’s recommendation and publicly disclose its decision and rationale within 90 days from the date the election results are certified. The director who tenders his or her resignation under the Director Resignation Policy will not participate in the Board’s decision. The Board has established a mandatory retirement age of 75 years for directors, as reflected in BlackRock’s Corporate Governance Guidelines. Director Nomination Process The Governance Committee oversees the director nomination process. The Committee leads the Board’s annual review of Board performance and reviews and recommends to the Board BlackRock’s Corporate Governance Guidelines, which include the minimum criteria for membership on the Board. The Governance Committee also assists the Board in identifying individuals qualified to become Board members and recommends to the Board a slate of candidates, which may include both incumbent and new director nominees, to submit for election at each annual meeting of shareholders. The Committee may also recommend that the Board elect new members to the Board to serve until the next annual meeting of shareholders. Identifying and Evaluating Candidates for Director The Governance Committee seeks advice on potential director candidates from current directors and executive officers when identifying and evaluating new candidates for director. The Governance Committee also may direct management to engage third-party firms that specialize in identifying director candidates to assist with its search. Shareholders can recommend a candidate for election to the Board by submitting director recommendations to the Governance Committee. For information on the requirements governing shareholder nominations for the election of directors, pleasesee “Deadlines for Submission of Proxy Proposals, Nomination of Directors and Other Business of Shareholders”on page 92. The Governance Committee then reviews publicly available information regarding each potential director candidate to assess whether the candidate should be considered further. If the Governance Committee determines that the candidate warrants further consideration, then the Chairperson (or a person designated by the Governance Committee) will contact the candidate. If the candidate expresses a willingness to be considered and to serve on the Board, then the Governance Committee typically requests information from the candidate and reviews the candidate’s accomplishments and qualifications against the criteria described below. The Governance Committee’s evaluation process does not vary based on whether a candidate is recommended by a shareholder, although the Governance Committee may consider the number of shares held by the recommending shareholder and the length of time that such shares have been held. BLACKROCK, INC. 2018 PROXY STATEMENT 9

| | | | | | | | | | | | | Item 1: Election of Directors ●Criteria for Board Membership | | | | |

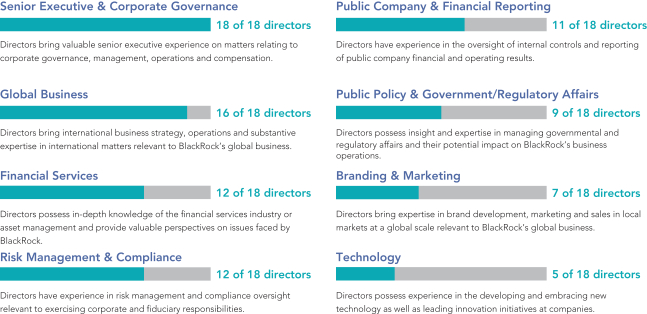

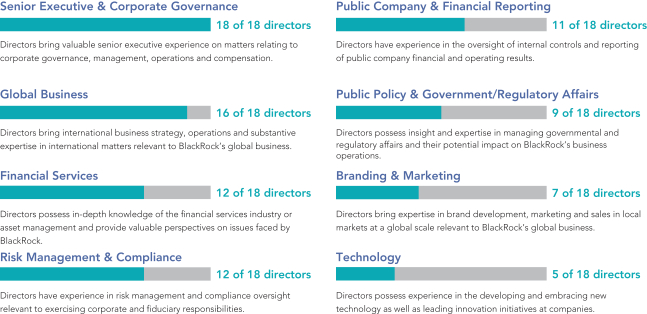

Criteria for Board Membership Director Qualifications and Attributes The Governance Committee and the Board take into consideration a number of factors and criteria in reviewing candidates for nomination to the Board. The Board believes, that at a minimum, a director candidate must demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of BlackRock. Equally important, a director candidate must have an impeccable record and reputation for honest and ethical conduct in his or her professional and personal activities. In addition, nominees for director are selected on the basis of experience, diversity, knowledge, skills, expertise, ability to make independent analytical inquiries, understanding of BlackRock’s business environment and a willingness to devote adequate time and effort to the responsibilities of the Board. Board Diversity BlackRock and its Board believe diversity in the boardroom is critical to the success of the Company and its ability to create long-term value for our shareholders. The Board has and will continue to make diversity in gender, ethnicity, age, career experience and geographic location – as well as diversity of mind – a priority when considering director candidates. The diverse backgrounds of our individual directors help the Board better evaluate BlackRock’s management and operations and assess risk and opportunities for the Company’s business model. BlackRock’s commitment to diversity enhances Board involvement in our Company’s multi-faceted long-term strategy and inspires deeper engagement with management, employees and clients around the world. Our Board has nominated 18 directors for election, 15 of whom are independent. The Board includes 5 women, 1 of whom is African American, and 6 directors who arenon-U.S. or dual citizens. Several of our nominees live and work overseas in countries and regions that are key areas of growth and investment for BlackRock, including Mexico, Canada, the United Kingdom and Continental Europe. As BlackRock’s business has evolved, so has its Board. Our Board consists of senior leaders (including 12 current or former company CEOs) with substantial experience in financial services, consumer products, manufacturing, technology, banking and energy, and several directors have held senior policy and government positions. To learn more about our Board, we encourage you to visit our website athttp://ir.blackrock.com/board-of-directors. Core qualifications and areas of expertise represented on our Board include:

10BLACKROCK, INC. 2018 PROXY STATEMENT

| | | | | | | | | | | | | Item 1: Election of Directors ●Criteria for Board Membership | | | | |

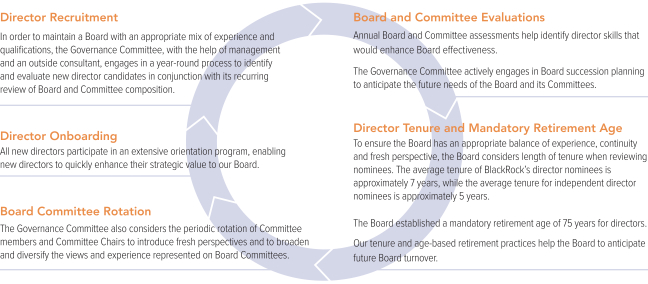

Board Tenure and Size To ensure the Board has an appropriate balance of experience, continuity and fresh perspective, the Board considers, among other factors, length of tenure when reviewing nominees. The average tenure of BlackRock’s director nominees is approximately 7 years, while the average tenure for independent director nominees is approximately 5 years. Six directors, comprising 33% of the Board, have served more than 10 years and bring a wealth of experience and knowledge concerning BlackRock. Five directors, comprising 28% of the Board, have served between 5 and 10 years. Following the 2018 Annual Meeting of Shareholders, assuming all of the nominated directors are elected, there will be seven directors, comprising 39% of the Board, who have joined the Board within the past 5 years and bring fresh perspective to Board deliberations. The Board has not adopted a policy that limits or sets a target for Board size and believes the current size and diverse composition of the Board is best suited to evaluate management’s performance and oversee BlackRock’s global strategy and risk management. As described in“Board Evaluation Process” on page 23, the Governance Committee and the Board evaluate Board and Committee performance and effectiveness on at least an annual basis and, as part of that process, ask each director to consider whether the size of the Board and its standing Committees are appropriate. Compliance with Regulatory and Independence Requirements The Governance Committee takes into consideration regulatory requirements, including competitive restrictions and financial institution interlocks, independence requirements under the NYSE listing standards and our Corporate Governance Guidelines in its review of director candidates for the Board and Committees. The Governance Committee also considers a director candidate’s current and past positions held, including past and present board and committee memberships, as part of its evaluation. Service on Other Public Company Boards Each of our directors must have the time and ability to make a constructive contribution to the Board as well as a clear commitment to fulfilling the fiduciary duties required of directors and serving the interests of the Company’s shareholders. BlackRock’s CEO does not currently serve on the board of directors of any other public company, and none of our current directors serve on more than four public company boards, including BlackRock’s Board. Director Candidate Search Consistent with BlackRock’sage-based retirement policy, at least 6 of BlackRock’s current directors will retire within the next 6 years, inclusive of Messrs. Al-Hamad and Grosfeld. In order to maintain a Board with an appropriate mix of experience and qualifications, the Governance Committee, with the help of management and an outside consultant, engages in a year-round process to identify and evaluate new director candidates in conjunction with its recurring review of Board and Committee composition. Consistent with our long-term strategic goals and the qualifications and attributes described above, search criteria include significant experience in financial services, the technology sector and consumer branding, as well as international experience. In March of this year, the Governance Committee selected William E. Ford, Margaret L. Johnson and Mark Wilson as director candidates with significant leadership and experience in asset management, technology and international financial services, respectively, and recommended each to the Board for consideration as director candidates for the Board. Ms. Johnson was recommended for consideration to the Governance Committee by a third-party search firm and Messrs. Ford and Wilson were referrals from our CEO. On March 15, 2018, following a review of the candidates’ qualifications and independence, the Board voted unanimously to elect each director candidate to our Board. Board Recommendation For this year’s election, the Board has nominated 18 director candidates. The Board believes these director nominees provide BlackRock with the combined depth and breadth of skills, experience and qualities required to contribute to an effective and well-functioning Board. The composition of the current Board reflects a diverse range of skills, qualifications and professional experience that is relevant to our global strategy, business and governance. The following biographical information about each director nominee highlights the particular experience, qualifications, attributes and skills possessed by each director nominee that led the Board to determine that he or she should serve as director. All director nominee biographical information is as of March 29, 2018. | | |

| | The Board of Directors recommends stockholdersshareholders vote “FOR”“FOR” the election of each of the following 1918 director nominees. |

BLACKROCK, INC. 2018 PROXY STATEMENT 11

| | | | | | | | | | | | | Item 1: Election of Directors ●Director Nominee Biographies | | | | |

Director Nominee Biographies | | |

| |

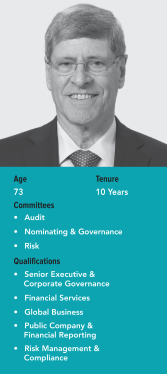

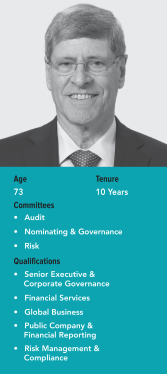

Mathis Cabiallavetta Director Nominee BiographiesMr. Cabiallavetta has served as a member of the board of directors of Swiss Re Ltd. since 2008 and as the Vice Chairman of its board between 2009 and 2015. Mr. Cabiallavetta retired as Vice Chairman, Office of the Chief Executive Officer of Marsh & McLennan Companies, Inc. and as Chairman of Marsh & McLennan Companies International in 2008. Prior to joining Marsh & McLennan Companies, Inc. in 1999, Mr. Cabiallavetta was Chairman of the board of directors of Union Bank of Switzerland (“UBS A.G.”).

Abdlatif Yousef Al-Hamad

| Director Since 2009, Age 78

Qualifications As a former leader of Swiss Re Ltd. and Marsh & McLennan Companies, Inc. as well as UBS A.G., Mr. Cabiallavetta brings executive experience from these large and complex multinational businesses and provides substantial expertise in global capital markets, and, as a result, he offers unique insights to the Board’s oversight of BlackRock’s global operations and risk management. Other Public Company Directorships (within the past 5 years) • Swiss Re Ltd. (2008 – present) (Vice Chairman from 2009 – 2015) • Philip Morris International Inc. (2002 – 2014) |

| | |

| | |

| | BlackRock Board Committee Memberships

Nominating and Governance Committee

Risk Committee

Other Public Company Directorships (within the past 5 years)

None

Experience and Qualifications

Mr. Al-Hamad has served as Director General and Chairman of the Board of Directors of the Arab Fund for Economic and Social Development since 1985. He was the Minister of Finance and Planning of Kuwait from 1981 to 1983 and prior to that served for 18 years as the Director General of the Kuwait Fund for Arab Economic Development. He is also a member of the Board

| of the Kuwait Investment Authority. Mr. Al-Hamad chaired the Development Committee Task Force on Multilateral Development Banks and has served on the International Advisory Boards of Morgan Stanley, Marsh & McLennan Companies, Inc., American International Group, Inc. and the National Bank of Kuwait.

Mr. Al-Hamad’s extensive experience in the strategically important Middle East region and his expertise in international finance, economic policy and government relations provide the Board with an experienced outlook on international business strategy and global capital markets.

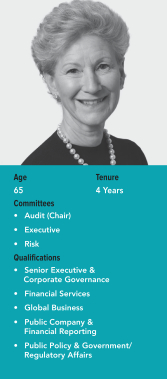

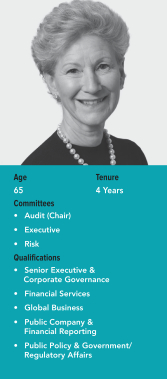

| | Pamela Daley Ms. Daley retired from General Electric Company (“GE”) in January 2014, having most recently served as a Senior Advisor to its Chairman from April 2013 to January 2014. Prior to this role, Ms. Daley served as Senior Vice President of GE’s Corporate Business Development from 2004 to 2013 and as Vice President and Senior Counsel for Transactions from 1991 to 2004. As Senior Vice President, Ms. Daley was responsible for GE’s mergers, acquisitions and divestiture activities worldwide. Ms. Daley joined GE in 1989 as Tax Counsel. Previously, Ms. Daley was a Partner of Morgan, Lewis & Bockius, where she specialized in domestic and cross-bordertax-oriented financings and commercial transactions. Ms. Daley currently serves as a director of SecureWorks Corp. Ms. Daley previously served on the board of BG Group, an international oil and gas company traded on the London Stock Exchange, until it was acquired by Royal Dutch Shell, and Patheon N.V., until it was acquired by Thermo Fisher, Inc. Qualifications With over 35 years of transactional experience and more than 20 years as an executive at GE, one of the world’s leading multinational corporations, Ms. Daley brings significant experience and strategic insight to the Board in the areas of leadership development, international operations, transactions, business development and strategy. Other Public Company Directorships (within the past 5 years) • SecureWorks Corp. (2016 – present) • Patheon N.V. (2016 – 2017) • BG Group (2014 – 2016) |

Mathis Cabiallavetta12BLACKROCK, INC. 2018 PROXY STATEMENT Age 73 Tenure 10 Years Committees Audit Nominating & Governance Risk Qualifications Senior Executive & Corporate Governance Global Business Risk Management & Compliance Financial Services Public Company & Financial Reporting Age 65 Tenure 4 Years Committees Audit (Chair) Executive Risk Qualifications Senior Executive & Corporate Governance Global Business Financial Services Public Company & Financial Reporting Public Policy & Government/ Regulatory Affairs

| | | | | | | | | | | | | Item 1: Election of Directors ●Director Nominee Biographies | | Director Since 2007, Age 71

|

| | |

| | BlackRock Board Committee Memberships

Audit Committee

Nominating and Governance Committee

Risk Committee

Other Public Company Directorships (within the past 5 years)

Swiss Re Ltd. (2008 – present) (Vice Chairman from 2009 – April 2015)

Philip Morris International Inc. (2002 – 2014)

Experience and Qualifications

Mr. Cabiallavetta has served as a member of the Board of Directors of Swiss Re Ltd. since 2008 and as the Vice Chairman of its Board between 2009 and 2015. Mr. Cabiallavetta retired as Vice

| Chairman, Office of the Chief Executive Officer of Marsh & McLennan Companies, Inc. and as Chairman of Marsh & McLennan Companies International in 2008. Prior to joining Marsh & McLennan Companies, Inc. in 1999, Mr. Cabiallavetta was Chairman of the Board of Directors of Union Bank of Switzerland (UBS A.G.).

As a former leader of Swiss Re Ltd. and Marsh & McLennan Companies, Inc. as well as Union Bank of Switzerland (UBS A.G.), Mr. Cabiallavetta brings executive experience from these large and complex multinational businesses and provides substantial expertise in global capital markets to the Board of Directors and unique insight and perspective to its oversight of the Company’s global operations and risk management.

|

Pamela Daley

| Director Since 2014, Age 63

|

| | |

| | BlackRock Board Committee Memberships

Audit Committee

Other Public Company Directorships (within the past 5 years)

BG Group (2014 – February 2016)

Experience and Qualifications

Ms. Daley retired from General Electric Company (“GE”) in January 2014 and served as a Senior Advisor to its Chairman from April 2013 to January 2014. Prior to this role, Ms. Daley served as Senior Vice President of GE’s Corporate Business Development from 2004 to 2013 and as Vice President and Senior Counsel for Transactions from 1991 to 2004. As Senior Vice President, Ms. Daley was responsible for GE’s mergers, acquisitions and divestiture activities worldwide.

| Ms. Daley joined GE in 1989 as Tax Counsel. Previously, Ms. Daley was a Partner of Morgan, Lewis & Bockius, where she specialized in domestic and cross-border tax-oriented financings and commercial transactions. Ms. Daley served on the board of BG Group, an international gas and oil company traded on the London Stock Exchange until February 15, 2016, when BG Group was acquired by Royal Dutch Shell.

With over 35 years of transactional experience and more than 20 years as an executive with GE, one of the world’s leading multinational corporations, Ms. Daley brings significant experience and strategic insight to the Board in the areas of leadership development, international operations, transactions, business development and strategy.

|

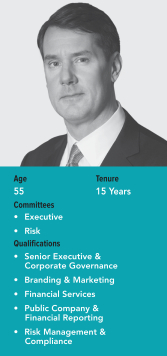

| | | William S. Demchak

| Director Since 2003, Age 53

|

| | | | |

| | BlackRock Board Committee Memberships

Executive Committee

Risk CommitteeWilliam S. Demchak

Other Public Company Directorships (within the past 5 years)

PNC (2013 – present) (Chairman from April 2014 – present)

Experience and Qualifications

Mr. Demchak has served as Chairman of the Board of Directors of PNC since April 2014, as Chief Executive Officer since April 2013 and as President since April 2012. Prior to that, Mr. Demchak held a number of supervisory positions at PNC, including Senior Vice Chairman, Head of Corporate and Institutional Banking and Chief Financial Officer. Before joining PNC in | 2002, Mr. Demchak served as the Global Head of Structured Finance and Credit Portfolio for J.P. Morgan Chase & Co. and additionally held key leadership roles at J.P. Morgan prior to its merger with Chase Manhattan Corporation in 2000.

As the Chairman, President and Chief Executive Officer of PNC, a large, national diversified financial services company providing traditional banking and asset management services, Mr. Demchak brings substantial expertise in financial services, risk management and corporate governance to bear as a member of the Board. Mr. Demchak was designated to serve on the Board by PNC pursuant to the implementation and stockholder agreement between PNC and BlackRock.

|

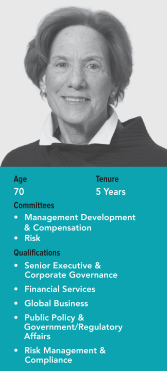

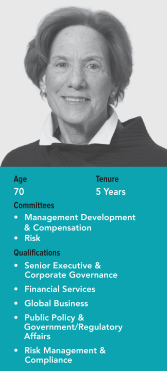

Jessica P. Einhorn

| Director Since 2012, Age 68

|

| | |

| | BlackRock Board Committee Memberships

Risk Committee

Other Public Company Directorships (within the past 5 years)

Time Warner, Inc. (2005 – present)

Experience and Qualifications

Ms. Einhorn served as Dean of the Paul H. Nitze School of Advanced International Studies at The Johns Hopkins University from 2002 until June 2012. Prior to becoming Dean, she was a consultant at Clark & Weinstock, a strategic consulting firm. She spent nearly 20 years at the World Bank, concluding as Managing Director in 1998. Between 1998 and 1999, Ms. Einhorn was a Visiting Fellow at the International Monetary Fund. Prior to joining the World Bank in

| 1978, she held positions at the U.S. Treasury, the U.S. State Department and the International Development Cooperation Agency of the United States. Ms. Einhorn currently serves as a Director of both the Peterson Institute for International Economics and the National Bureau of Economic Research. As of July 2012, Ms. Einhorn is resident at The Rock Creek Group in Washington, D.C., where she is a longstanding member of The Rock Creek Group Advisory Board.

Ms. Einhorn’s leadership experience in academia and at the World Bank, and experience in the U.S. government and at the International Monetary Fund, provides the Board of Directors with a unique perspective and in-depth understanding on issues concerning international finance, economics and public policy. Through her service with other public companies, Ms. Einhorn also has developed expertise in corporate governance and risk oversight.

|

Laurence D. Fink

| Director Since 1998, Age 63

|

| | |

| | BlackRock Board Committee Memberships

Executive Committee (Chairperson)

Other Public Company Directorships (within the past 5 years)

None

Experience and Qualifications

Mr. Fink has been Chairman and Chief Executive Officer of BlackRock since 1988. Mr. Fink also leads BlackRock’s Global Executive Committee and is a trustee of one of BlackRock’s open-end fund complexes.

As one of the founding principals and Chief Executive Officer of BlackRock since 1988, Mr. Fink brings exceptional leadership skills and in-depth understanding of BlackRock’s businesses,

| operations and strategy. His extensive and specific knowledge of the Company and its business enables him to keep the Board apprised of the most significant developments impacting the Company and to guide the Board’s discussion and review of the Company’s strategy. |

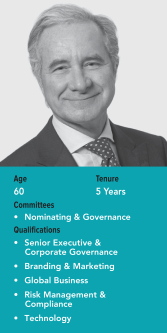

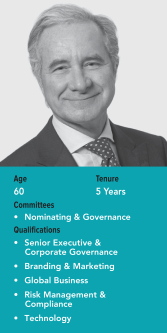

Fabrizio Freda

| Director Since 2012, Age 58

|

| | |

| | BlackRock Board Committee Memberships

Nominating and Governance Committee

Other Public Company Directorships (within the past 5 years)

The Estée Lauder Companies Inc. (2009 – present)

Experience and Qualifications

Mr. Freda has served as President and Chief Executive Officer of The Estée Lauder Companies Inc. (“Estée Lauder”) since July 2009, and is also a member of its Board of Directors. Mr. Freda previously served as Estée Lauder’s President and Chief Operating Officer from 2008 to July 2009. Estée Lauder is a global leader in beauty with more than 25 brands and over 40,000 employees worldwide. Prior to joining Estée Lauder, Mr. Freda held various senior positions at

| Procter & Gamble Company over the span of 20 years. From 1986 to 1988, Mr. Freda directed marketing and strategic planning for Gucci SpA.

Mr. Freda’s extensive experience in product strategy, innovation and global branding brings valuable insights to the Board. His Chief Executive experience at Estée Lauder, an established multinational manufacturer and marketer of prestige brands, provides the Company with unique perspectives on its own marketing, strategy and innovation initiatives.

|

Murry S. Gerber

| Director Since 2000, Age 63

|

| | |

| | BlackRock Board Committee Memberships

Audit Committee (Chairperson)

Executive Committee

Management Development and Compensation Committee

Risk Committee

Other Public Company Directorships (within the past 5 years)

U.S. Steel Corporation (2012 – present)

Halliburton Company (2012 – present)

EQT Corporation (1998 – 2012) (Chairman from 2000 – 2010 and Executive Chairman from 2010 – 2011)

| Experience and Qualifications

Mr. Gerber has served as a member of the Boards of Directors of U.S. Steel Corporation since July 2012 and Halliburton Company since January 2012. Previously, Mr. Gerber served as Executive Chairman of EQT Corporation, an integrated energy production company, from 2010 until May 2011, as Chairman and Chief Executive Officer of EQT Corporation from 2007 to 2010, as Chairman, Chief Executive Officer and President of EQT Corporation from 2000 to 2007 and as Chief Executive Officer and President of EQT Corporation from 1998 to 2000.

As a former leader of a large, publicly traded energy production company and as a current or former member of the board of directors of three large, publicly traded companies, Mr. Gerber brings to the Board of Directors extensive expertise and insight into corporate operations, management and governance matters, as well as expert knowledge of the energy sector.

|

James Grosfeld

| Director Since 1999, Age 78

|

| | |

| | BlackRock Board Committee Memberships

Management Development and Compensation Committee

Nominating and Governance Committee

Other Public Company Directorships (within the past 5 years)

Lexington Realty Trust (2003 – December 2015)

PulteGroup, Inc. (2015 – present)

Experience and Qualifications

Mr. Grosfeld was formerly Chairman of the Board and Chief Executive Officer of Pulte Homes, Inc. (renamed PulteGroup, Inc. in 2010), a home builder and mortgage banking and financing company, from 1974 to 1990 and rejoined the Board of the company in 2015 as an

| independent director. Mr. Grosfeld served as a trustee of Lexington Realty Trust from 2003 to 2015.

As the former Chairman and Chief Executive Officer of Pulte Homes, Inc., the nation’s largest homebuilder, Mr. Grosfeld provides the Board of Directors with practical management and leadership insight on public company governance as well as expertise in financial services and real estate matters.

|

Robert S. Kapito

| Director Since 2006, Age 59

|

| | |

| | BlackRock Board Committee Memberships

None

Other Public Company Directorships (within the past 5 years)

None

Experience and Qualifications

Mr. Kapito has been President of BlackRock since 2007. Mr. Kapito is also a member of the Global Executive Committee of BlackRock. Prior to 2007, Mr. Kapito served as Vice Chairman of BlackRock and Head of its Portfolio Management Group since 1988.

As one of the founding principals of the Company, Mr. Kapito has served as an executive leader of BlackRock since 1988. He brings to the Board of Directors industry and business acumen in

| addition to in-depth knowledge about BlackRock’s businesses, investment strategies and risk management as well as extensive experience overseeing the Company’s day-to-day operations. |

David H. Komansky

| Director Since 2003, Age 76

|

| | |

| | BlackRock Board Committee Memberships

Executive Committee

Management Development and Compensation Committee (Chairperson)

Other Public Company Directorships (within the past 5 years)

None

Experience and Qualifications

Mr. Komansky retired as Chairman of the Board of Merrill Lynch in 2003. Mr. Komansky became Chairman of the Board of Merrill Lynch in 1997, served as a director and Chief Executive Officer of Merrill Lynch from 1996 to 2002 and as a director, President and Chief Operating Officer of Merrill Lynch from 1995 to 1996. Previously, Mr. Komansky served as a

| director of WPP Group plc from 2003 to 2009.

| Mr. Komansky’s chief executive experience at Merrill Lynch and his financial and management expertise provides the Board of Directors with a valuable perspective and leadership insights on a wide range of corporate governance and management matters unique to complex financial organizations. |

Sir Deryck Maughan

| Director Since 2006, Age 68

|

| | |

| | BlackRock Board Committee Memberships

Executive Committee

Management Development and Compensation Committee

Risk Committee (Chairperson)

Other Public Company Directorships (within the past 5 years)

GlaxoSmithKline plc (2004 – present)

Thomson Reuters (2008 – 2014)

Experience and Qualifications

Sir Deryck served as a Senior Advisor of Kohlberg Kravis Roberts & Co. L.P. (“KKR”) from January 2013 until December 2014. Previously, he was a Partner and Head of the Financial

| Institutions Group of KKR since 2009 and Managing Director since 2005. He was Chairman of KKR Asia from 2005 to 2009. Prior to joining KKR, Sir Deryck served as Vice Chairman of Citigroup from 1998 to 2004, as Chairman and Chief Executive Officer of Salomon Brothers from 1992 to 1997 and as Chairman and Chief Executive Officer of Salomon Brothers Asia from 1986 to 1991. He also was Vice Chairman of the U.S.-Japan Business Council from 2002 to 2004. Prior to joining Salomon Brothers in 1983, Sir Deryck worked at Goldman Sachs. He served in H.M. Treasury (UK Economics and Finance Ministry) from 1969 to 1979. He has also served as a Director of GlaxoSmithKline plc since 2004 and Thomson Reuters from 2008 to 2014.

| Sir Deryck’s internationally focused leadership positions at KKR, a global leader in private equity, fixed income and capital markets, and at Citigroup and Salomon Brothers provide the Board of Directors with a valuable perspective on international finance and global capital markets and extensive experience in assessing value, strategy and risks related to various business models. |

Cheryl D. Mills

| Director Since 2013, Age 51

|

| | |

| | BlackRock Board Committee Memberships

Management Development and Compensation Committee

Other Public Company Directorships (within the past 5 years)

None

Experience and Qualifications

Ms. Mills is Founder and Chief Executive Officer of the BlackIvy Group, an investment company that grows and builds businesses in Sub-Saharan Africa. Formerly, she served as Chief of Staff to Secretary of State Hillary Clinton and Counselor to the U.S. Department of State from 2009 to 2013. Ms. Mills was with New York University from 2002 to 2009, where she served as Senior Vice President for Administration and Operations and as General Counsel. She also served as

| Secretary of the University’s Board of Trustees. From 1999 to 2001, Ms. Mills was Senior Vice President for Corporate Policy and Public Programming at Oxygen Media. Prior to joining Oxygen Media, Ms. Mills served as Deputy Counsel to President Clinton and as the White House Associate Counsel. She began her career as an Associate at the Washington, D.C. law firm of Hogan & Hartson. Ms. Mills previously served on the boards of Cendant Corporation (now Avis Budget Group, Inc.), a consumer real estate and travel conglomerate, and Orion Power, an independent electric power generating company.

Ms. Mills brings to the Board of Directors a range of leadership experiences from government and academia and through her prior service on the boards of corporations and non-profits, she provides expertise on issues concerning government relations, public policy, corporate administration and corporate governance.

|

Gordon M. Nixon, C.M., O.Ont.

| Director Since 2015, Age 59

|

| | |

| | BlackRock Board Committee Memberships

Management Development and Compensation Committee

Risk Committee

Other Public Company Directorships (within the past 5 years)

BCE Inc. (2014 – present)

George Weston Limited (2014 – present)

Experience and Qualifications

Mr. Nixon was President, Chief Executive Officer and a Director of Royal Bank of Canada from 2001 to 2014. He first joined RBC Dominion Securities Inc. in 1979, where he held a number of operating positions and served as Chief Executive Officer from December 1999 to April 2001. He

| currently serves as a Director of BCE, Inc. and will be nominated as Chairman upon his re-election to the Board in April 2016. He is also a Director of George Weston Limited and is on the advisory board of Kingsett Capital.

With 13 years of experience leading a global financial institution and one of Canada’s largest public companies, Mr. Nixon brings extensive expertise and perspective to the Board on global markets and in-depth knowledge of the North American market. His experience growing a diversified, global financial services organization in a highly regulated environment also provides the Board with valuable insight into risk management, compensation and corporate governance matters.

|

Thomas H. O’Brien*

| Director Since 1999, Age 79

|

| | |

| | BlackRock Board Committee Memberships

Audit Committee

Executive Committee

Nominating and Governance Committee (Chairperson)

Other Public Company Directorships (within the past 5 years)

Verizon Communications, Inc. (1987 – 2011)

Experience and Qualifications

Mr. O’Brien retired as Chief Executive Officer of PNC in 2000, after 15 years in that position, and retired as Chairman of PNC in 2001, after 13 years in that position. Mr. O’Brien previously served as a Director of Verizon Communications, Inc. from 1987 to 2011.

| As a former leader of PNC, one of the largest diversified financial services companies in the United States, Mr. O’Brien has valuable insights on corporate governance and the U.S. financial and banking sectors to share with the Board of Directors and the Company, particularly in his role as lead independent director.

*The Board of Directors has selected Mr. O’Brien to serve as the lead independent director.

|

Ivan G. Seidenberg

| Director Since 2011, Age 69

|

| | |

| | BlackRock Board Committee Memberships

Audit Committee

Nominating and Governance Committee

Other Public Company Directorships (within the past 5 years)

Verizon Communications, Inc. (2002 – 2011) (Chairman from 2004 – 2011)

Boston Properties, Inc. (2014 – present)

Experience and Qualifications

Mr. Seidenberg retired as the Chairman of the Board of Verizon Communications, Inc. in December 2011 and previously served as its Chief Executive Officer from 2002 to 2011. Prior to the creation of Verizon Communications, Inc., Mr. Seidenberg was the Chairman and Chief

| Executive Officer of Bell Atlantic and NYNEX Corp. Mr. Seidenberg has been an Advisory Partner of Perella Weinberg Partners, a global independent advisory and asset management firm, since June 2012 and a member of the Board of Directors of Boston Properties, Inc. since May 2014. Mr. Seidenberg also previously served on the boards of Honeywell International Inc. and Wyeth, LLC.

Mr. Seidenberg brings extensive executive leadership, technological and operational experience to the Board from his tenure at Verizon Communications, Inc., one of the world’s leading providers of communications services. Through his extensive experience on the boards of public companies, he has developed an in-depth understanding of business and corporate governance.

|

Marco Antonio Slim Domit

| Director Since 2011, Age 47

|